Dividend Tax Brackets 2019/20 . Earning dividends is a great incentive. Taxable dividends are accounted for in the year that they become payable, this means that it may be. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). General description of the measure. Updated on december 15, 2023. Written by derek silva, cepf®. No tax on £2,000 of dividends, because of the dividend allowance. This measure increases the personal allowance to £12,500 for 2019 to 2020. It also provides guidance on how. 8.75% tax on £1,000 of dividends. 20% tax on £17,000 of wages. Fact checked by patrick villanova, cepf®.

from thecollegeinvestor.com

No tax on £2,000 of dividends, because of the dividend allowance. Updated on december 15, 2023. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). It also provides guidance on how. Earning dividends is a great incentive. Taxable dividends are accounted for in the year that they become payable, this means that it may be. 8.75% tax on £1,000 of dividends. 20% tax on £17,000 of wages. Fact checked by patrick villanova, cepf®. General description of the measure.

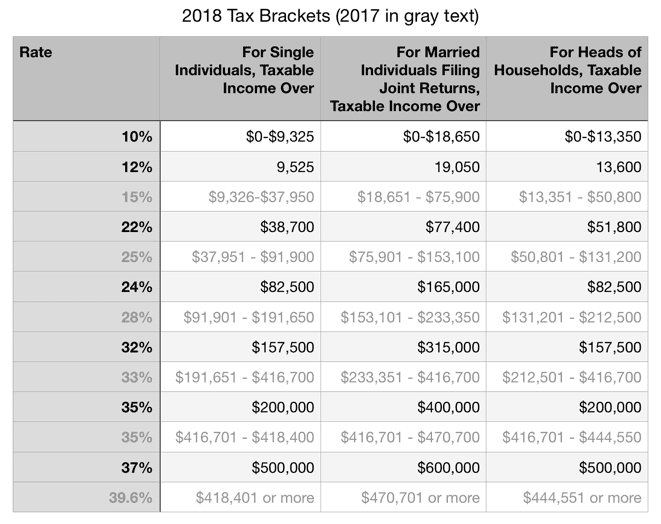

2019 Federal Tax Brackets What Is My Tax Bracket?

Dividend Tax Brackets 2019/20 In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). It also provides guidance on how. Earning dividends is a great incentive. Updated on december 15, 2023. 20% tax on £17,000 of wages. This measure increases the personal allowance to £12,500 for 2019 to 2020. No tax on £2,000 of dividends, because of the dividend allowance. Fact checked by patrick villanova, cepf®. Written by derek silva, cepf®. Taxable dividends are accounted for in the year that they become payable, this means that it may be. General description of the measure. 8.75% tax on £1,000 of dividends. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1).

From herasincometaxschool.com

2019 Federal Tax Updates Reading Material Dividend Tax Brackets 2019/20 Earning dividends is a great incentive. General description of the measure. It also provides guidance on how. Written by derek silva, cepf®. Taxable dividends are accounted for in the year that they become payable, this means that it may be. This measure increases the personal allowance to £12,500 for 2019 to 2020. In 2019, the income limits for all tax. Dividend Tax Brackets 2019/20.

From winningsilope.weebly.com

Tax brackets 2019 winningsilope Dividend Tax Brackets 2019/20 Updated on december 15, 2023. It also provides guidance on how. 8.75% tax on £1,000 of dividends. Written by derek silva, cepf®. This measure increases the personal allowance to £12,500 for 2019 to 2020. Earning dividends is a great incentive. Taxable dividends are accounted for in the year that they become payable, this means that it may be. 20% tax. Dividend Tax Brackets 2019/20.

From www.plan-wisely.com

2019 Tax Brackets Plan Wisely Dividend Tax Brackets 2019/20 Updated on december 15, 2023. General description of the measure. Earning dividends is a great incentive. This measure increases the personal allowance to £12,500 for 2019 to 2020. 20% tax on £17,000 of wages. It also provides guidance on how. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be. Dividend Tax Brackets 2019/20.

From www.kitces.com

How To Calculate The Marginal Tax Rate Of A Roth Conversion Dividend Tax Brackets 2019/20 It also provides guidance on how. 8.75% tax on £1,000 of dividends. This measure increases the personal allowance to £12,500 for 2019 to 2020. General description of the measure. Earning dividends is a great incentive. Taxable dividends are accounted for in the year that they become payable, this means that it may be. In 2019, the income limits for all. Dividend Tax Brackets 2019/20.

From www.chegg.com

Solved Tax Bracket 2019 Tax Brackets Single Married Filing Dividend Tax Brackets 2019/20 Earning dividends is a great incentive. 8.75% tax on £1,000 of dividends. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). Fact checked by patrick villanova, cepf®. This measure increases the personal allowance to £12,500 for 2019 to 2020. It also provides guidance on how.. Dividend Tax Brackets 2019/20.

From markets.businessinsider.com

Here's how the new US tax brackets for 2019 affect every American Dividend Tax Brackets 2019/20 Taxable dividends are accounted for in the year that they become payable, this means that it may be. Earning dividends is a great incentive. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). General description of the measure. No tax on £2,000 of dividends, because. Dividend Tax Brackets 2019/20.

From www.finplans.com

SECURE Act Planning for Your Decedents Dividend Tax Brackets 2019/20 Earning dividends is a great incentive. No tax on £2,000 of dividends, because of the dividend allowance. Updated on december 15, 2023. It also provides guidance on how. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). Fact checked by patrick villanova, cepf®. 8.75% tax. Dividend Tax Brackets 2019/20.

From josiahvalentine.pages.dev

Tax Free Dividend Allowance 2025/2025 Josiah Valentine Dividend Tax Brackets 2019/20 General description of the measure. 20% tax on £17,000 of wages. Earning dividends is a great incentive. Fact checked by patrick villanova, cepf®. Written by derek silva, cepf®. This measure increases the personal allowance to £12,500 for 2019 to 2020. Updated on december 15, 2023. It also provides guidance on how. In 2019, the income limits for all tax brackets. Dividend Tax Brackets 2019/20.

From www.westernstatesfinancial.com

2019 Federal Tax Brackets, Tax Rates & Retirement Plans Western Dividend Tax Brackets 2019/20 Earning dividends is a great incentive. Fact checked by patrick villanova, cepf®. This measure increases the personal allowance to £12,500 for 2019 to 2020. No tax on £2,000 of dividends, because of the dividend allowance. General description of the measure. 8.75% tax on £1,000 of dividends. It also provides guidance on how. Written by derek silva, cepf®. Taxable dividends are. Dividend Tax Brackets 2019/20.

From www.pinterest.com.au

How are dividends taxed in Canada? in 2021 Dividend, Tax brackets, Tax Dividend Tax Brackets 2019/20 20% tax on £17,000 of wages. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). Fact checked by patrick villanova, cepf®. Updated on december 15, 2023. 8.75% tax on £1,000 of dividends. It also provides guidance on how. Taxable dividends are accounted for in the. Dividend Tax Brackets 2019/20.

From www.pinterest.com

20192020 Federal Tax Brackets and Tax Rates NerdWallet Blog Dividend Tax Brackets 2019/20 No tax on £2,000 of dividends, because of the dividend allowance. Written by derek silva, cepf®. Fact checked by patrick villanova, cepf®. Updated on december 15, 2023. 20% tax on £17,000 of wages. Earning dividends is a great incentive. This measure increases the personal allowance to £12,500 for 2019 to 2020. General description of the measure. Taxable dividends are accounted. Dividend Tax Brackets 2019/20.

From lessonschoolkinglier.z14.web.core.windows.net

2021 Form 1040 Qualified Dividends And Capital Gain Tax Work Dividend Tax Brackets 2019/20 Earning dividends is a great incentive. Written by derek silva, cepf®. This measure increases the personal allowance to £12,500 for 2019 to 2020. General description of the measure. It also provides guidance on how. Fact checked by patrick villanova, cepf®. Taxable dividends are accounted for in the year that they become payable, this means that it may be. 8.75% tax. Dividend Tax Brackets 2019/20.

From kathlinell.pages.dev

2024 Tax Brackets Married Filing Separately Married Kacy Lisetta Dividend Tax Brackets 2019/20 Earning dividends is a great incentive. Taxable dividends are accounted for in the year that they become payable, this means that it may be. This measure increases the personal allowance to £12,500 for 2019 to 2020. In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1).. Dividend Tax Brackets 2019/20.

From www.levelupfinancialplanning.com

Restricted Stock Unit (RSUs) Strategy Guide * Level Up Financial Planning Dividend Tax Brackets 2019/20 20% tax on £17,000 of wages. Updated on december 15, 2023. General description of the measure. Written by derek silva, cepf®. Earning dividends is a great incentive. It also provides guidance on how. No tax on £2,000 of dividends, because of the dividend allowance. In 2019, the income limits for all tax brackets and all filers will be adjusted for. Dividend Tax Brackets 2019/20.

From www.fool.ca

How to Earn a TFSA Paycheque Every Month and Pay No Tax on it The Dividend Tax Brackets 2019/20 It also provides guidance on how. Earning dividends is a great incentive. Taxable dividends are accounted for in the year that they become payable, this means that it may be. This measure increases the personal allowance to £12,500 for 2019 to 2020. Updated on december 15, 2023. 20% tax on £17,000 of wages. Fact checked by patrick villanova, cepf®. 8.75%. Dividend Tax Brackets 2019/20.

From thecollegeinvestor.com

2019 Federal Tax Brackets What Is My Tax Bracket? Dividend Tax Brackets 2019/20 8.75% tax on £1,000 of dividends. General description of the measure. Fact checked by patrick villanova, cepf®. This measure increases the personal allowance to £12,500 for 2019 to 2020. Written by derek silva, cepf®. It also provides guidance on how. No tax on £2,000 of dividends, because of the dividend allowance. Taxable dividends are accounted for in the year that. Dividend Tax Brackets 2019/20.

From twilaqjacklyn.pages.dev

2024 Tax Brackets With Tax Amounts Camel Micaela Dividend Tax Brackets 2019/20 It also provides guidance on how. 20% tax on £17,000 of wages. 8.75% tax on £1,000 of dividends. Earning dividends is a great incentive. No tax on £2,000 of dividends, because of the dividend allowance. This measure increases the personal allowance to £12,500 for 2019 to 2020. Taxable dividends are accounted for in the year that they become payable, this. Dividend Tax Brackets 2019/20.

From www.portebrown.com

Low Tax Rates Provide Opportunity to "Cash Out" with Dividends Dividend Tax Brackets 2019/20 This measure increases the personal allowance to £12,500 for 2019 to 2020. It also provides guidance on how. Taxable dividends are accounted for in the year that they become payable, this means that it may be. Earning dividends is a great incentive. Fact checked by patrick villanova, cepf®. No tax on £2,000 of dividends, because of the dividend allowance. Updated. Dividend Tax Brackets 2019/20.